The new point of sale is changing everything

A deep dive into the impact POS has across the retail landscape

Retail is back - and customers expect more

Retailers are breathing a sigh of relief as sales increase following 2020 volatility, with Forrester estimating that US retail sales will grow 4% in 2021, primarily from an increase in online purchases of 15.5%.

However, the pandemic allowed customers to examine their values and what they want from the brands that serve them. The result is they want not only ease and convenience but also service.

According to an international Accenture survey, the “reimagined consumer” now represents 50% of shoppers. These reimagined consumers changed their values during the pandemic, and nearly half of them desire new tools and improved shopping advisory services using digital channels.

“Everywhere commerce” is another trend, allowing customers to buy from anywhere and pick up their purchases from store, locker, delivery, or other channels.

One of the biggest changes has been around how customer string shopping experiences together.

With rolling closures and lockdowns, more consumers have embraced ecommerce but that doesn't mean they’ve stopped shopping in-store. Instead, they expect a seamless interaction between physical and digital touchpoints.

Retailers must now be more agile than ever while providing an exceptional customer experience. A Salesforce study of 12,000 global consumers and 3,600 businesses revealed that 80% of consumers view “flawless engagement” as being just as important as product quality. Nearly 70% want companies to offer traditional products and services in new formats, especially desired by Millennials and Gen-Z. However, the most critical takeaway for retailers is this:Over 90% of customers are willing to re-purchase after a great service experience.

Retailers respond with increasing agility

Success now hinges on their ability to respond at lightning speed to meet evolving customer preferences.

Return depots, curbside pickup, video chat, virtual appointment, and social selling are all part of the expanding omnichannel strategy retailers now use to serve customers and stay competitive. Novel store formats are also gaining popularity. New offerings include pop-up stores that offer an immersive shopping experience, showcase new collections, or serve as an innovative short-term storefront. Pop ups have gained traction across verticals from high-end apparel, to food, or pet supplies.

Agile retailers are also using innovative fulfillment channels to re-purpose real estate and overcome last-mile delivery hurdles. “Dark stores” have become popular with retailers including Whole Foods, who use them as mini-fulfillment centers to serve online-only purchases.. This approach allows retailers to use existing retail or other convenient locations to efficiently pick-and-pack customer orders from a small space and provide quick delivery. Some retailers are also adding robotics that vastly increases the number of orders fulfilled in a small footprint.

The lesson here isn’t that a new store format or engagement channel is going to be a silver bullet, but rather that adaptability and agility trump all.

The retailers that listen to their customers, think creatively, and execute quickly are winning the race. We know that the pace of change is accelerating. Rather than white knuckle it, the retailers in the lead are preparing for change by embedding agility across their organizations.

Can legacy POS systems keep pace?

Most were designed decades ago and don’t consider modern retail expectations

Point-of-sale (POS) systems are the heart and lungs of the retail-consumer ecosystem, driving efficiency and effectiveness across the organization. Because of its central role, the POS needs to integrate in-store and online purchases and fulfillment options, support evolving customer preferences and strategic priorities, and capture and leverage data appropriately across the organization. But traditional POS systems are not keeping pace with new demands.

These systems were built around retailer data requirements, not customer behaviors and they’ve struggled to adapt to new retail business models. As a result, traditional POS systems create barriers, not flow, across the organization. Executives, IT teams, store associates, and customers are all forced to work around technology that’s highly-fragmented and largely incompatible with how modern retail actually works.

Challenges with legacy POS solutions.

Impact legacy POS systems have on each stakeholder

While the problems might not be obvious from the outside, the entire retail ecosystem is affected by underperforming an POS.

Challenges for Retail Executives

Forced to make decisions based on tech limitations instead of strategic priorities

Retail executives need to make strategic and operational changes to respond to customer needs and evolving best practices if they’re going to succeed in today’s tumultuous retail environment. Digital-first brands are able to pivot almost instantaneously, setting up new experiences, changing the customer journey, and offering new levels of personalization on an almost daily basis. By contrast, most enterprise retailers are battling with legacy POS systems that often can’t be adapted for new use cases—at least not without long timelines and high costs.

By now, retailers understand that customers expect a contextual and responsive experience, and that customers are more comfortable than ever changing brands if their expectations aren’t met. Retailers have invested in strategic and digital teams and put an emphasis on customer experience (CX) throughout their organization—but many are struggling to transition from concept to broad-scale execution. For 87% of enterprise CIOs, “complexity of existing infrastructure” is the key barrier standing in the way of implementing next-generation services.

Retail leaders have been working around the constraints of their legacy POS systems for as long as anyone can remember. As recently as 2018, 70% of executives indicated that they wanted to keep their core systems as long as possible. But that equation is changing in a post-pandemic world as legacy systems cause increasing strategic impediments and limit the retailer's ability to be responsive.

Challenges for IT

Caught in constant upgrade and maintenance projects just to keep infrastructure working

IT’s role in the enterprise retail organization has become increasingly complex. Most organizations are still supporting highly customized on-premise legacy systems that require tribal knowledge and constant hands-on attention to keep running. As these systems age and successive layers of customizations and integrations are layered in, they become increasingly unwieldy to maintain and upgrade. Some companies spend up to 80% of their IT budget just maintaining their infrastructure, with very little space left for growth or evolution.

When it comes to the POS specifically, there are three major elements that create undue barriers for IT. Firstly, server maintenance and store data rooms mean that upgrades require major projects multiple times per year. Secondly, customizations or new features can only come from the POS vendor and almost always come with a long timeline and high price tag. Finally, integrations with other retail systems are far from seamless and require constant attention, especially during upgrades on either side.

This isn’t to simply say that IT is busy—there is a real business impact because the ‘magic’ happens when strategy and technology are working in lockstep. A recent McKinsey study found that top performing companies bridge the business-technology gap significantly better than their less successful peers. In short, IT’s ability to serve the business has demonstrable impact on the bottomline, but that’s difficult to do with legacy systems.

A seasoned associate may have the product, systems, and customer knowledge required to make it all work, but it takes new associates months, if not years, to reach the level of required execution.

Challenges for Store Associates

Limited in how they can serve customers and drive sales—especially across channels

Store associates are the face of the retail organization. They want to be efficient and give their customers a smooth end-to-end experience but are constrained by system limitations. It isn’t getting any easier. Just before the pandemic, 47% of retail professionals told Forrester that omnichannel programs have increased the demands on store associates to multitask. Fast forward to today, and customers have become accustomed to the information availability and personalization that comes with online shopping. In response, the associate needs to serve as a digitally equipped guide who can flow seamlessly between channels and help inform decisions for both ecommerce and physical store purchases

Legacy POS solutions make it difficult for associates to rise to the occasion. Questions like “Which size did I buy last year?” can be impossible to answer. Requests like “Can’t you just ship it to me from online?” force the associate to reveal an uncomfortable disparity—while the customer might be able to pull out their mobile device, confirm product availability, and checkout in a few clicks, the associate has a much slower and more manual process, especially if the customer is looking to take some items home and have others shipped from

the warehouse.

With today’s labor challenges, this just doesn’t work. Retailers need to be confident that they can onboard and train new hires quickly and effectively, and as the number one system that high-selling associates are using, the POS is make or break.

Part of the problem comes from a mismatch—the customer thinks about their interaction with the brand holistically and doesn’t see a divide between channels or stages.

Challenges for Customers

Have become expert online shoppers and expect the same level of convenience in store

The majority of retailers are aiming for customer-centricity, but according to Forrester only 8% qualify as truly ‘customer obsessed.’ However, this 8% lays claim the industry’s highest growth rates in revenue, profitability, market share, customer retention, and employee engagement. Each stakeholder in the retail ecosystem is working towards customer experience, but even the most sophisticated teams can’t overcome hurdles around legacy technology.

Every customer is familiar with not being able to find products or get answers to questions, having to wait ages to checkout, and an almost punitive returns process. Historically, these inconvenient aspects of shopping were a price the customer was willing to pay—but that’s not the case anymore. Customers now expect a certain level of efficiency and personalization across every touchpoint. By contrast, many retailers have disparate teams and systems for different corporate functions, with information silos and a firm divide between ecommerce and brick-and-mortar operations.

While the divide is nothing new, the pain caused by it is growing. According to a recent study by PYMNTS and Visa, “the more consumers have been exposed to digital shopping tools, the less patience they seem to have for the frictions that have long accompanied in-store shopping, such as checkout lines and product shortages.”

What's the alternative?

The modern POS as a silent force for agility, scalability, and CX

For a long time, retailers and their customers accepted that these barriers were necessary evils that everyone had to work around. Executives planned strategies around IT constraints and customers expected certain parts of shopping to be time consuming and even frustrating–but no one knew any other way.

Digital native brands have played a pivotal role in changing expectations on both sides of the checkout counter. They come from a different age where legacy POS constraints with on-premise data rooms are a non-starter. Some brands launched their brick and mortar operations using more flexible SMB Point of Sale systems but have run into compliance and scale issues as they’ve grown. Others, like Warby Parker, built their own POS from scratch, requiring substantial resources to create and maintain.

By contrast, most POS systems used by enterprise retailers were designed over 30 years ago and can’t keep up with modern omnichannel demands.

They manage massive customer bases and store footprints but were built on legacy architecture and are built to maintain an outdated status quo.

We’ve come a long way since then, both in terms of customer expectations and technological capabilities.

Enterprise solutions can’t keep up with omnichannel demands. But, more agile and modern solutions can’t cope with millions of SKUs, complex enterprise requirements, and global compliance needs.

Unlike constraining legacy systems or SMB solutions, next gen POS systems can actually be the silent force that drives agility, scalability, and a great customer experience.

What defines a silent POS?

The impact a silent POS has on each stakeholder

A next gen point of sale is the linchpin between strategy and execution, allowing retailers to offer exceptional customer experiences at scale.

Advantages for Retail Executives

Able to adapt and scale based on evolving customer needs

Right now, we’re seeing the best retailers in the world creating innovative experiences that break down channels and turn casual shoppers into brand loyalists. Glossier, a DTC makeup brand, moved into physical retail in 2016 and shortly thereafter took the crown from Apple for bringing in the most revenue per square foot with their systematized high-touch process. Chanel has taken an entirely different view of the market. In recent years, they’ve launched pop-ups, created a concierge service for delivery, and developed a presence on social sites like WeChat, but have staunchly avoided treading into true ecommerce territory.

“We aren’t stubborn. We developed a lot of [online] content for our teams in the boutiques to engage with clients but the experience always ends up in stores. It’s something we are very vigilant about and that has been working rather well. There are alternatives to e-commerce. Pure e-commerce is not an end per se. Service is much more important.”

The right approach is highly dependent on the retailer. What matters is having the ability to innovate and strategize. Ideas about launching a marketplace, opening a return depot, or customizing products might make sense on paper, but without the right systems, their feasibility stops there. Unlike with a legacy POS, next-gen systems are designed to be silent. For retail leaders, this means that they don’t need to spend a lot of time thinking about POS and can stay focused on strategy, innovation and growth.

Advantages for IT

Free to support the business through advancement and innovation

The most successful retailers use their IT teams as strategic enablers. Business leaders identify an opportunity, problem, or outcome and look to IT to develop a solution. For brands that are focused on creating a custom-centric omnichannel experience, the POS is inevitably a major part of this equation—and there are a few specific elements that allow IT to operate as a true partner.

Firstly, time spent on maintenance and upgrade projects can be significantly reduced. By trading local data rooms for cloud hosting, applications stay current and new features are available for IT to turn on at will. Secondly, next-gen POS solutions give IT teams the ability to extend and customize the core functionality, without being entirely reliant on the vendor. As consumers, we’ve all gotten used to how easy it is to install an app and extend the functionality of our phones. Enterprise tech can and should essentially work the same way.

Finally, The POS system may be critical, but much of its value comes from how it centralizes data and processes from the full breadth of retail systems. Next- gen POS systems alleviate integration pain and eliminate data silos by connecting easily with other systems and offering the composable infrastructure that lets IT be responsive.

“We’ve put lots of technology in the hands of our associates through the peak of the pandemic. Our stylists in our stores have generated nearly $150 million in revenue from technology.”

Advantages for Store Associates

Equipped to deliver smooth customer experiences and make the most of sales time

Associates are key. “The retail workforce is almost more important than in pre-pandemic days,” said Ron Thurston, vice president of stores at Intermix. “I always tell retailers, these are the people with the most knowledge of your brand, the customers and product feedback.”

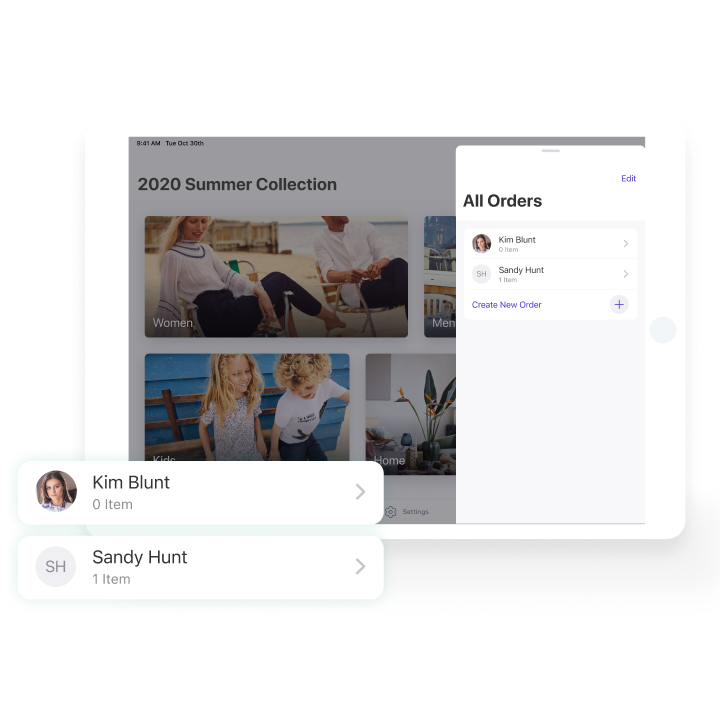

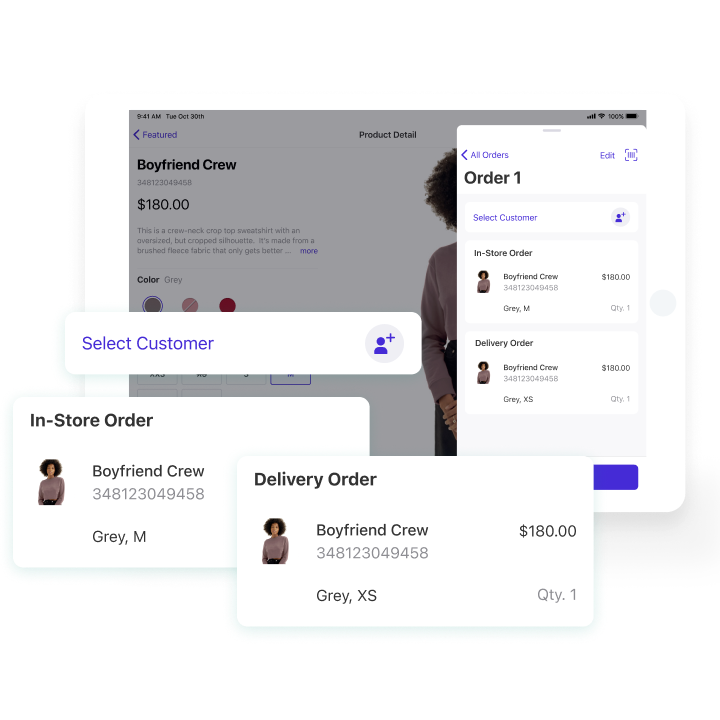

A next-gen POS can turn every associate into a great associate. Unlike legacy systems, next-gen solutions are built for how associates actually work. They guide the associate through each stage of the customer journey with intuitive UI and automated prompts for next steps. They let associates manage multiple customers at once, locate products at other stores, and make one-off requests work. Their biggest value is that they let associates be responsive.

Saks Fifth Avenue is a 153-year old retailer known for its beautiful stores and high-touch customer experience. Associates guide customers around the store with almost flawless precision and can always find the perfect product, even if it’s not actually in the store.

As the pandemic closed doors and changed shopping habits, Saks responded quickly, implementing virtual appointments and online chat with stylists, facilitating remote selling, and turning stores into mini-fulfillment centers with curbside pickup and same-day delivery.

Advantages for Customers

Able to shop in the channel-less environment they’ve come to expect

Customers are gravitating toward brands that feel authentic and that lean into what makes them unique. Founded in 1971, Mulberry’s iconic style—inspired by hunting, fishing, and other English rural pursuits—informs every aspect of the brand’s customer experience. When Mulberry opened their London flagship store, they entirely re-thought how to create a customer-centric journey that brings “Somerset serenity and London energy.”

Mulberry turned the store into an omnichannel experience hub. They made the location feel like a chic lounge by doing away with the checkout line and letting customers make purchases from anywhere in the store. They eliminated inconveniences by accepting local payment types from across the world and increased customer convenience with endless aisle and ship-to-home capabilities

A high-touch personalized experience has become a de facto expectation. But it doesn’t always look the same. The 1:1 luxury experience is right for some customers, others value inventory access, pick-up efficiency, or return convenience. Regardless of product type or vertical, what’s important is that the systems and processes that support the customer experience are invisible so that the entire experience feels effortless, efficient and unified across channels.

Where do we go from here?

Retailers now prioritize POS upgrades to deliver on the promise of unified commerce

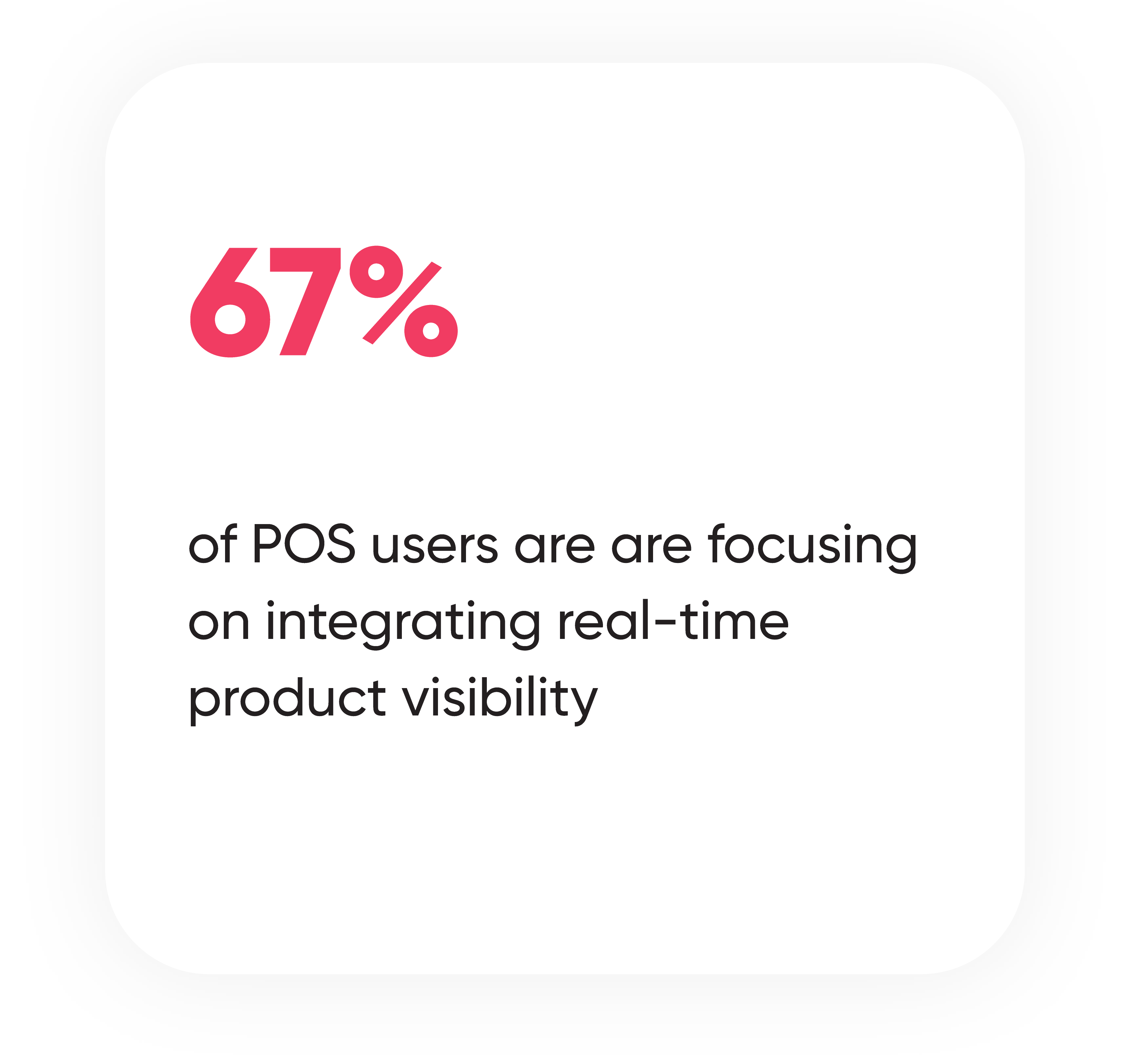

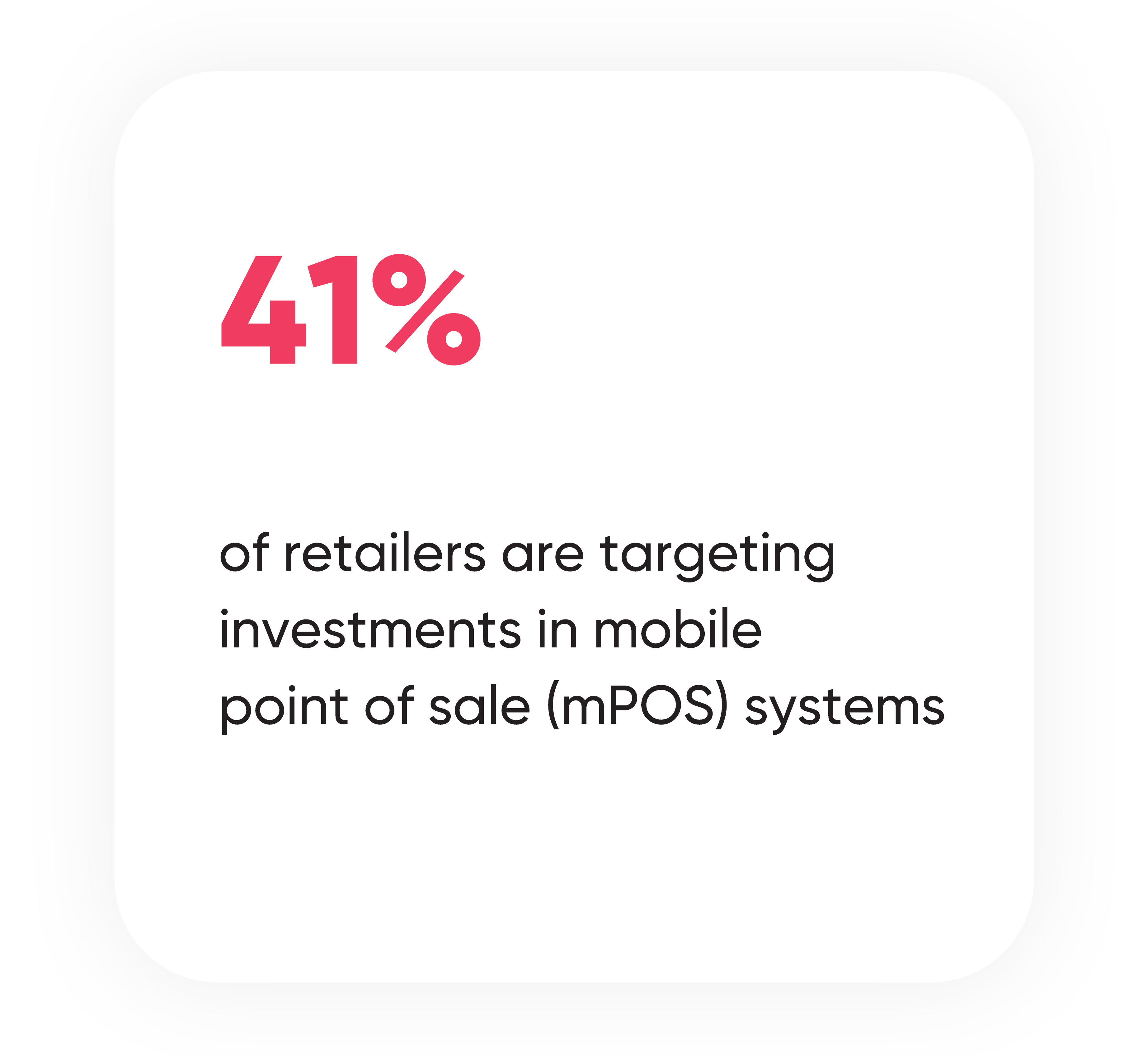

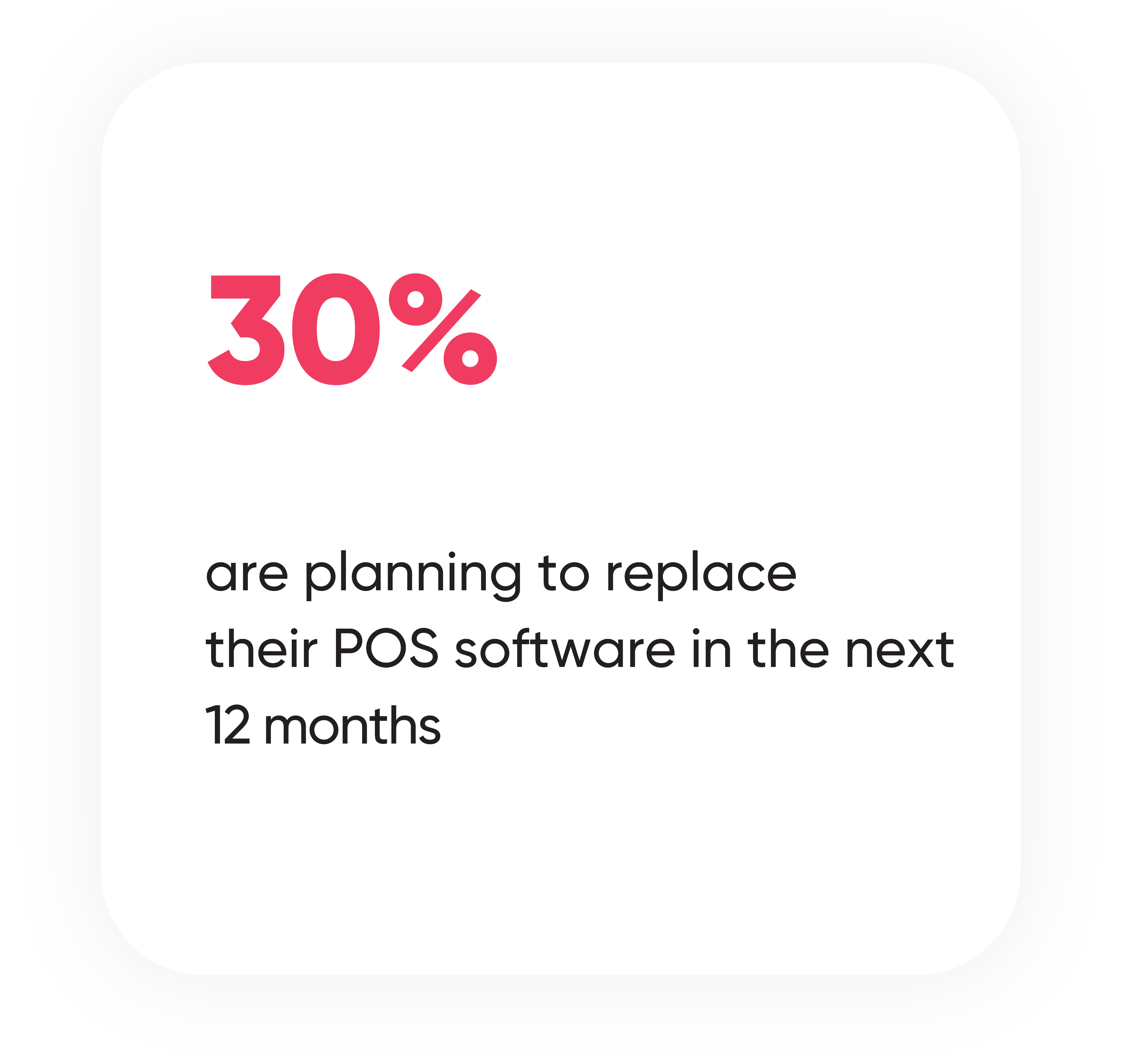

In their 2021 POS & Customer Engagement Report, Retail Consulting Partners surveyed retail vice presidents, directors of store systems, and IT and C-level executives to better understand their strategic priorities and where POS fit into the equation. Almost across the board, those surveyed indicated that they were preparing to invest in technology to support and improve the omnichannel customer experience.

As customer shifts have redefined the retail landscape in the past year, retailers are re-evaluating the POS value proposition. Extensible cloud-based architecture, flexible integration, and lower cost of ownership are primary factors driving increased appetite for next gen POS solutions.

While some retailers are seeking to conduct a full ‘heart and lung’ transplant by ripping out legacy technology and replacing it entirely, many others opt to pursue a component extension strategy.

Forrester describes this process in their Predictions 2022: Digital Commerce Report as follows. “Start by curating your ideal end state, then replace the wonky bits with new capabilities and add cloud-native components like promotions engines, subscription billing, or marketplace selling enablers. Over time, you’ll be operating a new engine for all but the core, which becomes an easier, final swap to make.”

The opportunity derived from a silent POS

Retailers are breathing new life into the shopping experience, delivering agility while responding to unique customer preferences. Today’s consumers want convenience, personalization, and service - on their terms.

The reward is that consumers build trust in the brands that support their preferences and deliver an exceptional experience.

Traditional POS systems can no longer support current customer demands for a seamless shopping experience--nevermind what’s coming tomorrow. A next-gen POS changes the equation by giving retailers a flexible and scalable way to operate. And, unlike its predecessors, a next-gen POS is a silent POS.

There is no clunky hardware, but beyond the obvious, a silent POS connects people, applications, and processes. It lets data flow, helps turn ideas into reality, and facilitates the efficient omnichannel experience everyone is chasing.

About

Tulip provides a suite of cloud-based solutions that let retailers overcome industry challenges and set a new standard for omnichannel commerce. Partnered with Apple and Salesforce, Tulip equips sophisticated retailers to build connections with customers, fulfill orders, checkout purchases, and optimize operations in order to create the end-to-end experience modern customers expect. Leading retailers like Mulberry, Saks Fifth Avenue, Kendra Scott, Kate Spade, COACH, and Michael Kors use Tulip to elevate the shopping experience, increase sales, and improve customer service across channels.