6 Strategies for Managing the Retail Labor Shortage

How retailers can navigate ongoing labor shortages and position staff for success in a post-pandemic world

Executive summary

COVID-19 sent massive disruptions through global labor markets and accelerated a paradigm shift among North American workforces.

The combination of rising customer expectations, heavier work demands on associates, stagnating minimum wages, and the reality checks the pandemic inspired, have changed how retailers need to think about staffing their stores.

Many retailers have focused on innovative ways to recruit new associates, but that’s only half the equation. This guide will look at how to get additional productivity out of the resources you have. It will look at six key strategies that the world’s top retailers are using to thrive despite a constrained labor market

"Only a crisis – actual or perceived – produces real change. When that crisis occurs, the actions that are taken depend on the ideas that are lying around."

The labor market shortage and its impact on the retail sector

Retailers have faced mounting pressure to evolve from both customers and employees for years, but the pandemic has drastically accelerated the urgency.

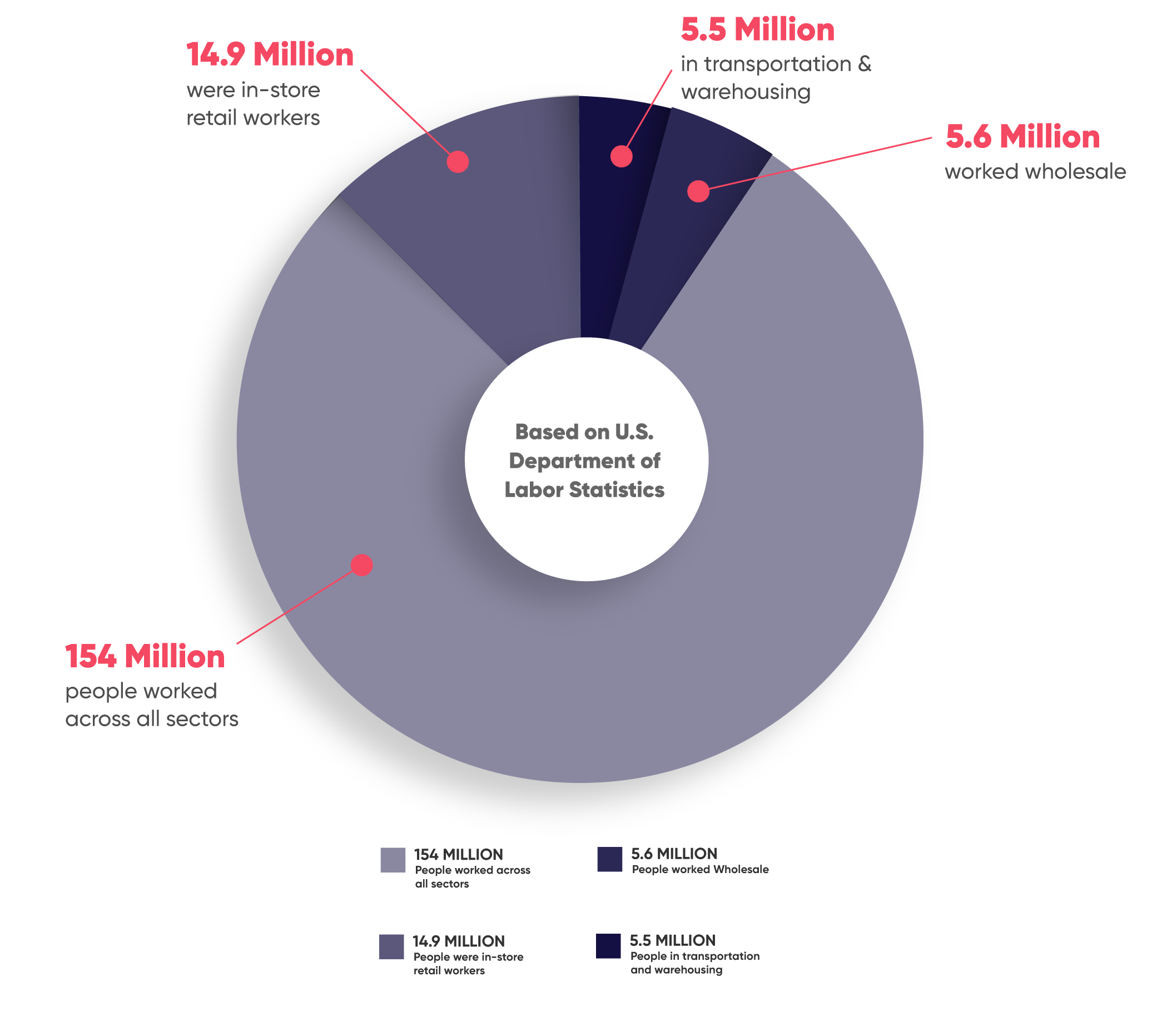

In 2019, the U.S. labor market enjoyed the highest employment rates it had seen in the last 50 years. Two years later, businesses across the nation report more empty positions than ever before. A record-breaking number of jobs became available in the U.S. over the course of 2021, reaching 11 million vacant positions this past October and employers have struggled to fill them.

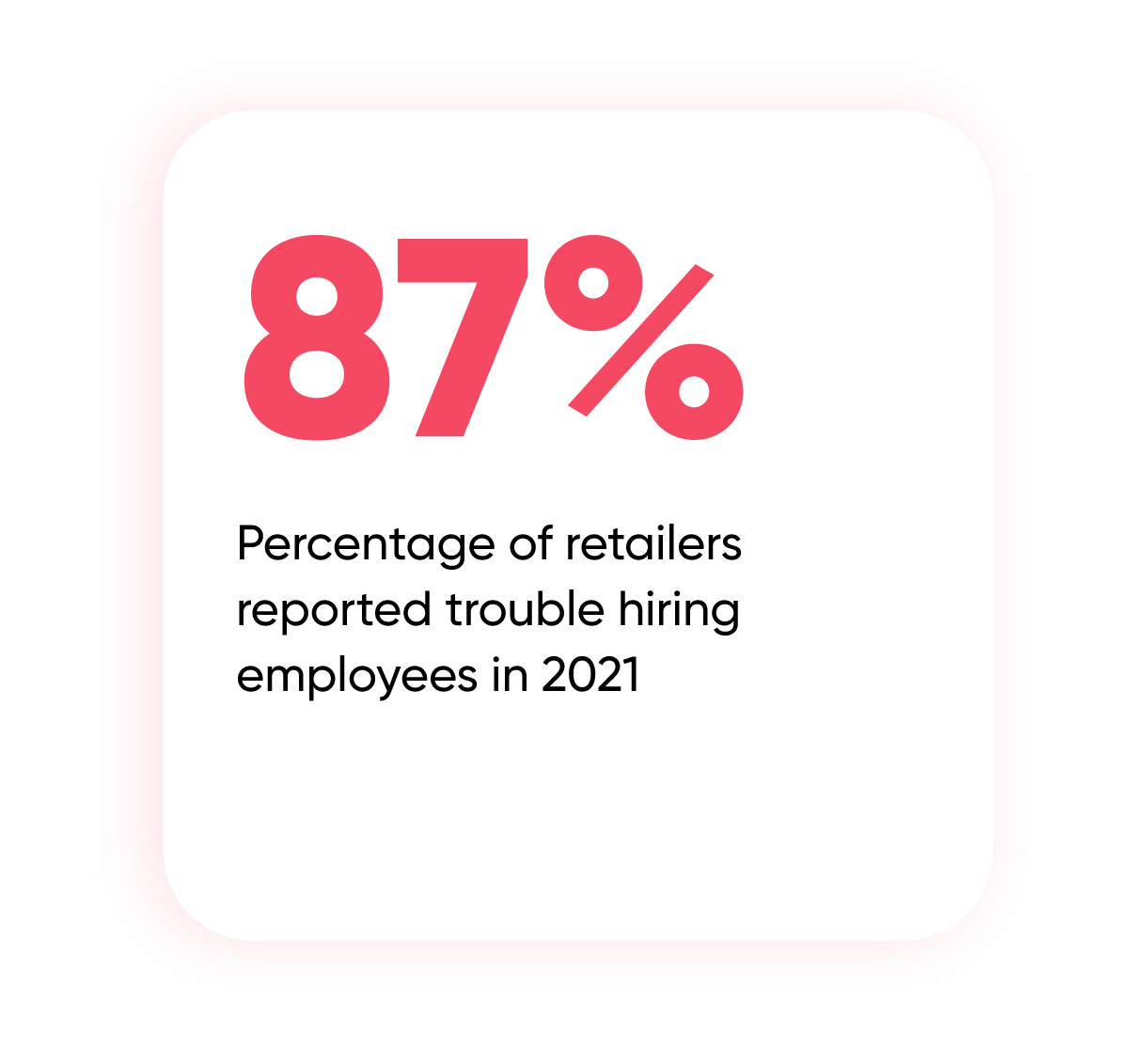

Retail has been one of the hardest hit industries with nearly 650,000 retail workers putting in notice in April 2021 alone. The retail industry accounts for a massive portion of the job market and with 4.2% of the population currently out of work and seeking new employment, it would seem businesses shouldn’t have such a difficult time filling their vacancies. But after the health and safety risks presented by COVID-19, and the varying degrees of responses workers encountered during its worst days, would-be employees now judge their potential workplaces by much stricter standards.

Though in truth, while some of today’s staffing challenges were stirred up by the pandemic, most were already coming around. For instance, even before COVID-19 sent waves in 2020, 53% of retail and brand professionals were having trouble properly training staff to manage online orders in our ever-digitizing age of omnichannel service. And retail surveys from as far back as 2017 show 80% of shoppers felt more knowledgeable about products than actual store associates.

The Washington Post conducted interviews with dozens of retail workers and noticed that “nearly all said the pandemic introduced new strains to already challenging work: longer hours, understaffed stores, unruly customers and even pay cuts.”

The pandemic led retail workers to view employers with greater scrutiny and inspired them to reassess their personal worth and the value they bring to stores. According to a McKinsey survey, the long periods of lockdown caused roughly two-thirds of U.S. employees to begin reconsidering their entire purpose in life. All of this is especially true for workers of the retail industry, where employees commonly earn low wages and receive limited benefits or stability.

Store associate roles are getting more complex to support omnichannel demands

Customers have different shopping expectations than they did pre-pandemic, and much of the burden to adapt and stay competitive is falling directly on store associates.

The labor shortage is causing pain across the retail industry, but when it comes to staffing stores there are additional complications. Associates play a massive role in welcoming customers, helping them make purchase decisions, and creating the overall experience. This is impactful for two reasons. Firstly, vacancies and inconsistencies are immediately noticed. Secondly, and perhaps more importantly, because of the central role associates play in interacting with customers, their role has to evolve in tandem with customers expectations.

Just before the pandemic, 47% of retail professionals told Forrester that omnichannel programs have increased the demands on store associates to multitask. Fast forward to today, and customers have become accustomed to the information availability and personalization that comes with online shopping and expect that same unified experience to extend into the store.

After enjoying the advantages of curbside pickups, same-day deliveries with real-time tracking, and streamlined ordering processes that remember their favorite selections, 66% of customers believe retailers should already understand how to meet their needs and personal expectations the moment they walk through the door (or start browsing online). Floor associates are being asked to do much more to meet customers’ evolving expectations and they’re finding themselves vastly unprepared, with reports of undertrained and overworked retail staff multiplying since the pandemic began.

The depth of brand knowledge associates are expected to have on-hand for products both in-store and online has risen dramatically. Levels of product guidance once unique to retail giants, who made associate expertise a central part of their image, are now expected of retail associates nearly everywhere.

Across verticals, associates now need to facilitate high-touch personal experiences that flow effortlessly between channels and let customers shop in micro-moments. Sound like a tall order? It is.

The job of the retail store associate is getting harder.

“Luxury owned that high-touch relationship,” said Saks Fifth Avenue President and CEO, Marc Metrick. “Then, over time, data became the greatest equalizer, and almost everyone was able to personalize things more.”

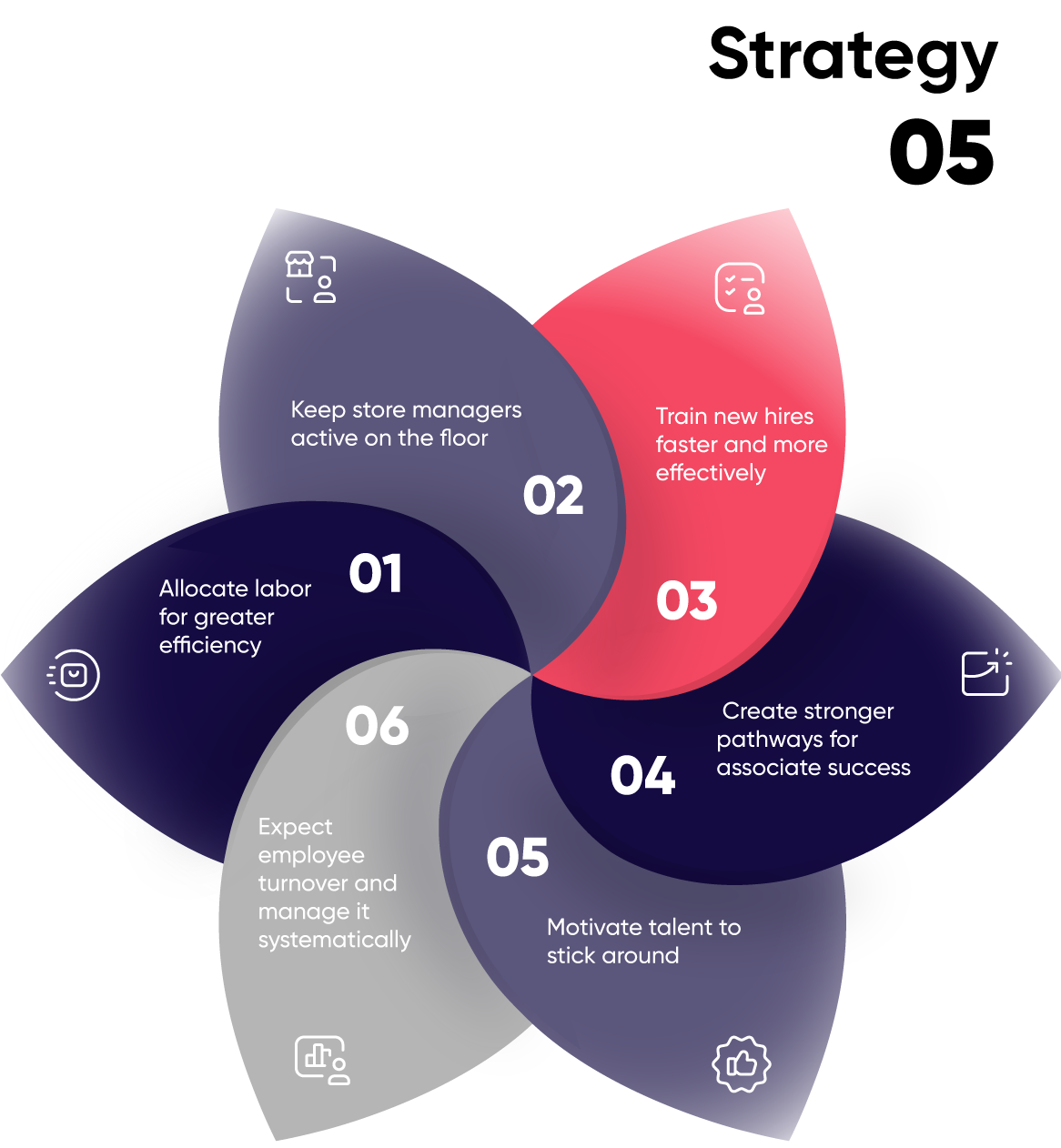

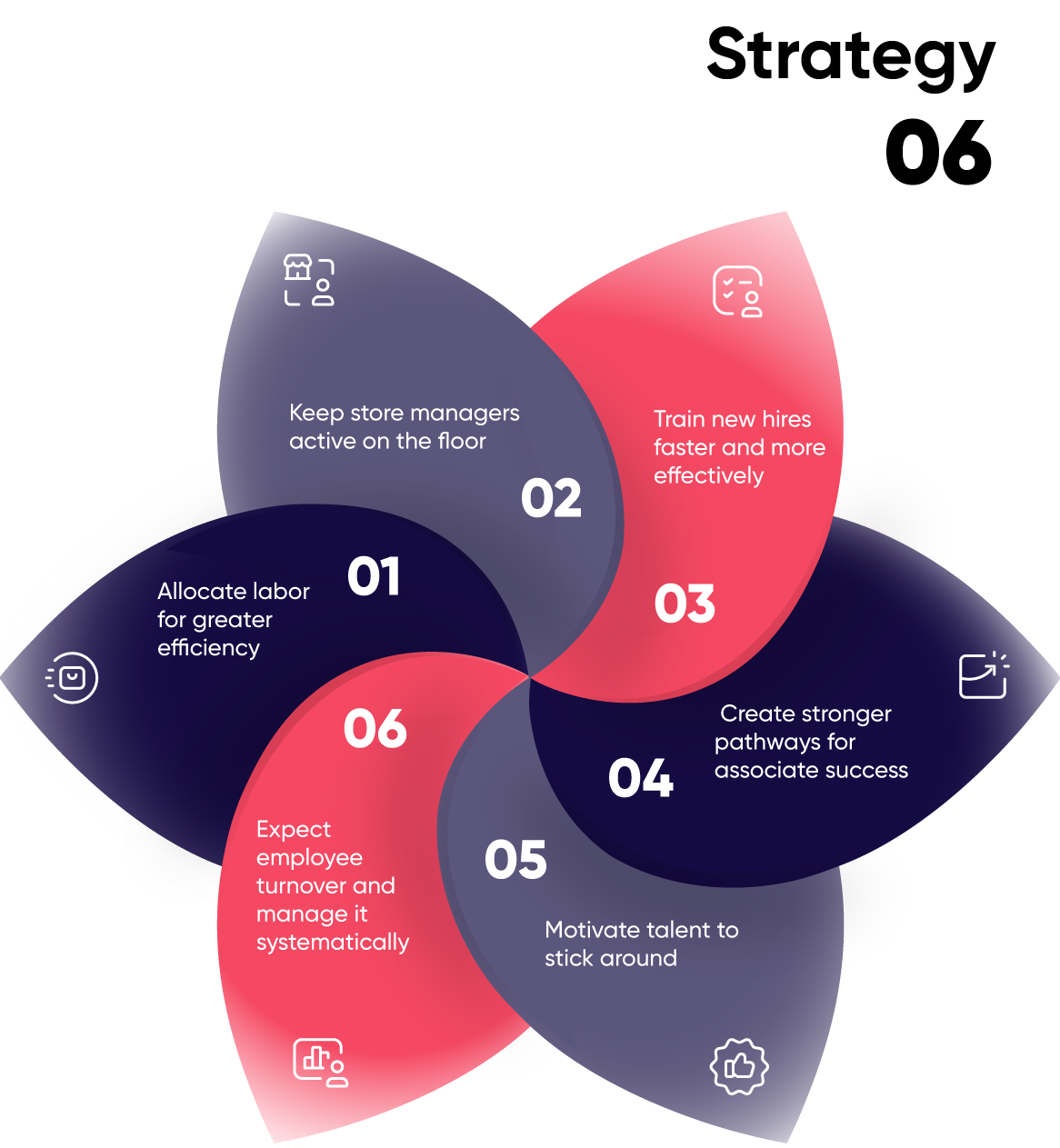

6 strategies retailers can deploy to overcome labor shortage challenges

How top retailers are staffing stores effectively despite a constrained labor market and sky-high customer expectations

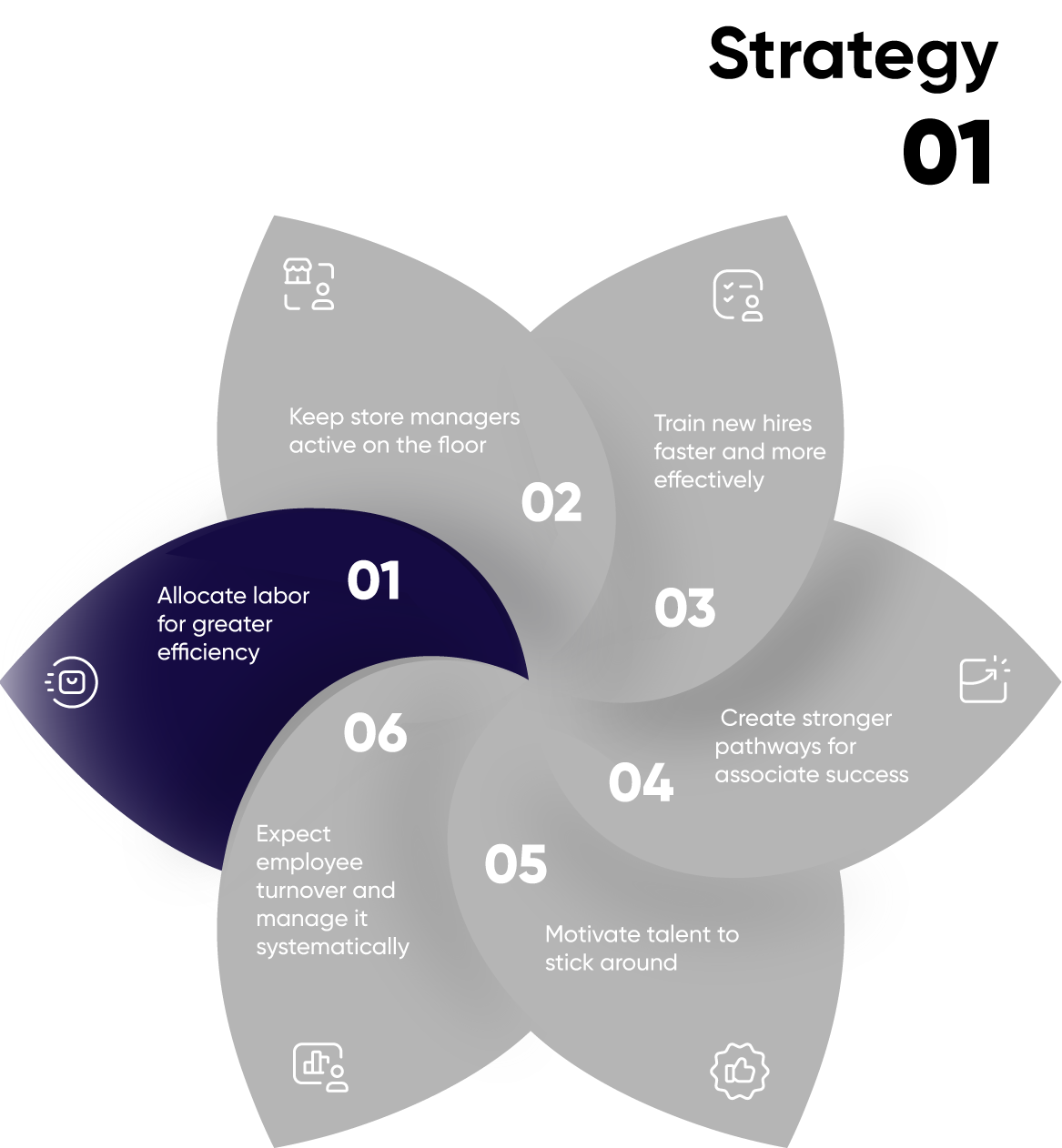

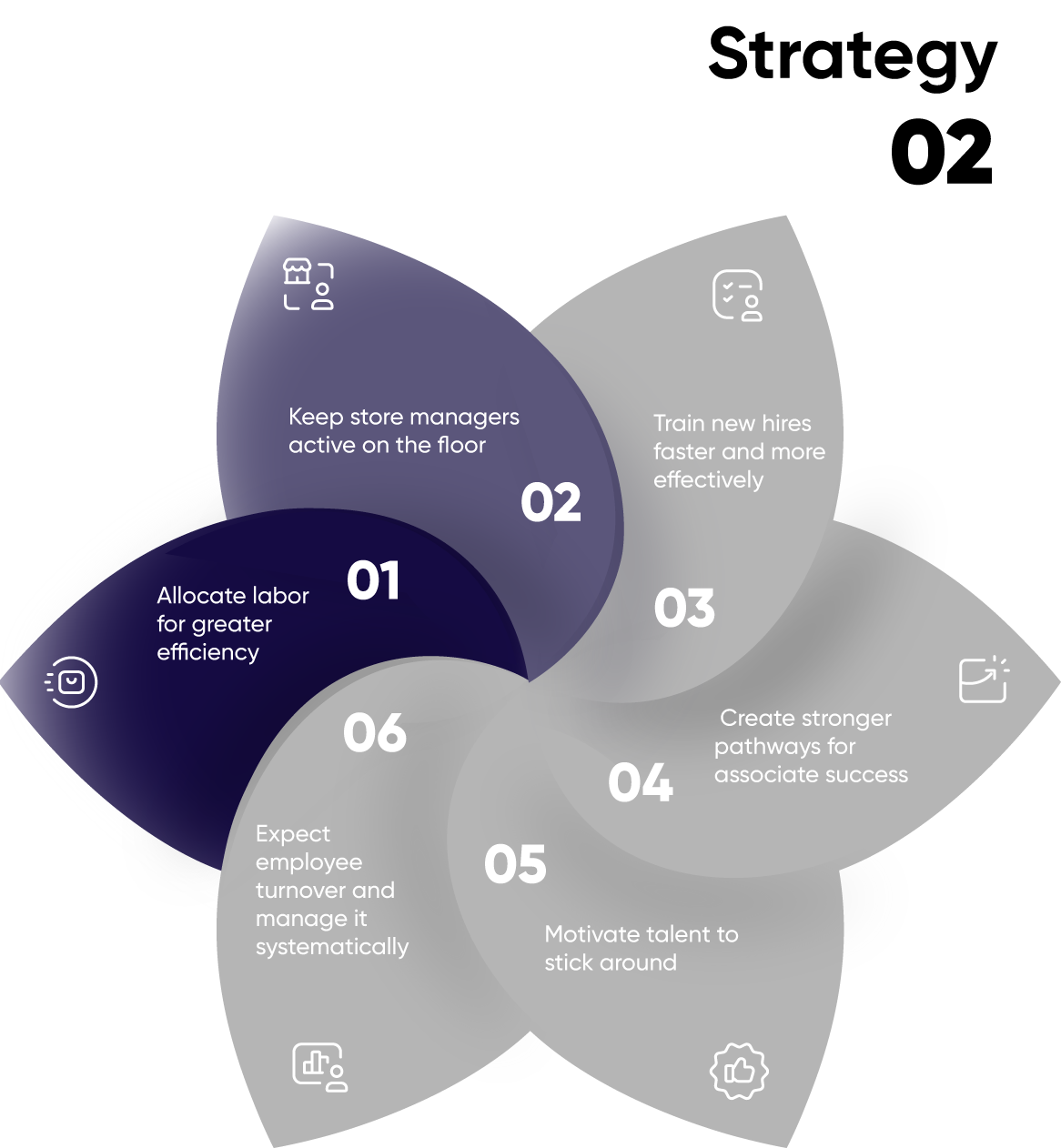

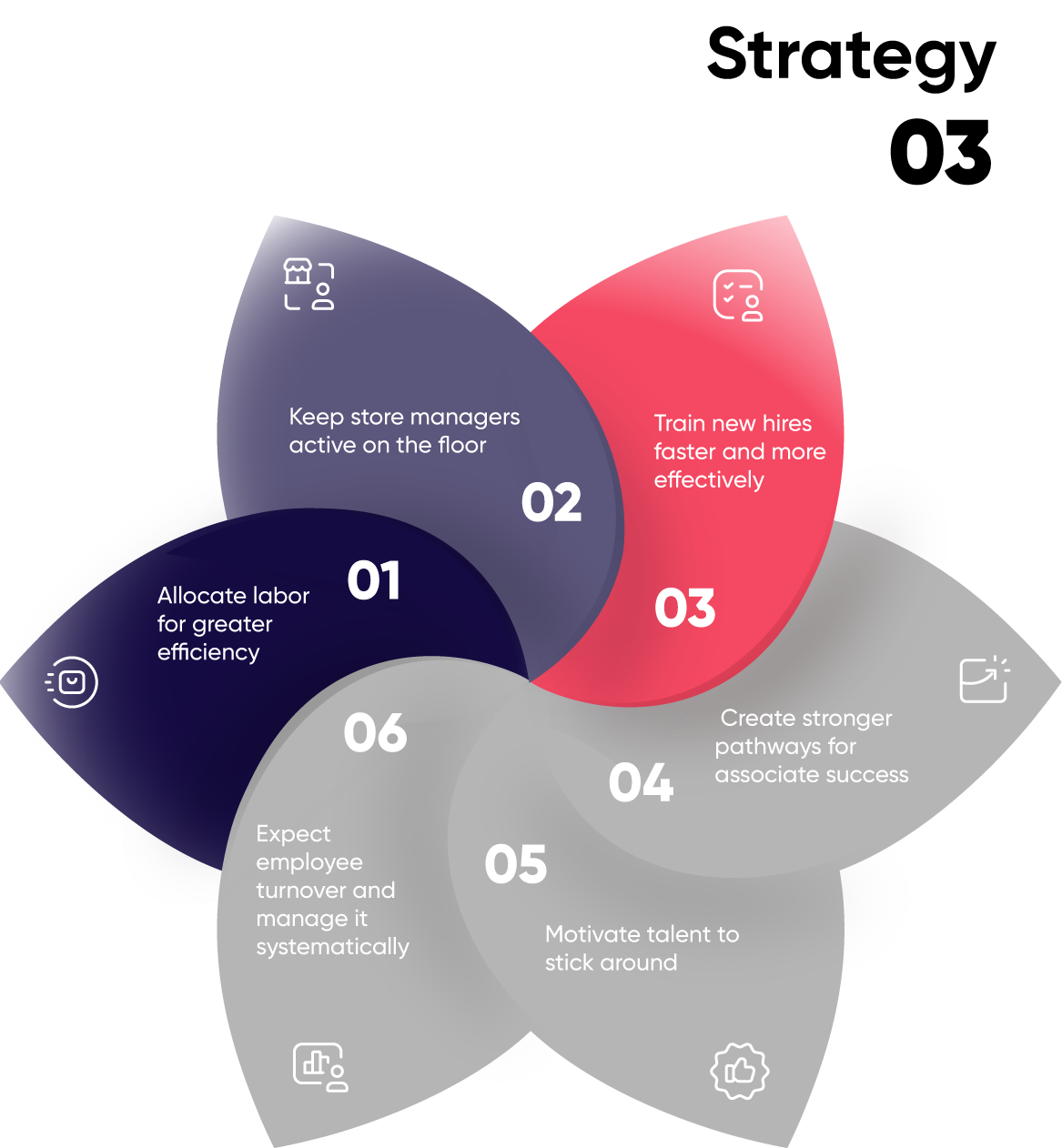

Strategy 1

Allocate labor for greater efficiency

Before looking outward for new hires, the very first thing retailers need to do is optimize the talent they have on-deck.

The basic act of analyzing employee schedules for improvement and assigning talent based on their individual strengths brings most retailers massive performance improvements, especially when navigating staff shortages. The truth is, not all staff members are equally skilled across the board—some work better on specific days, in tandem with other associates, or in certain areas of the store. While an experienced manager may naturally notice some of these operational levers, even the best are unlikely to catch them all.

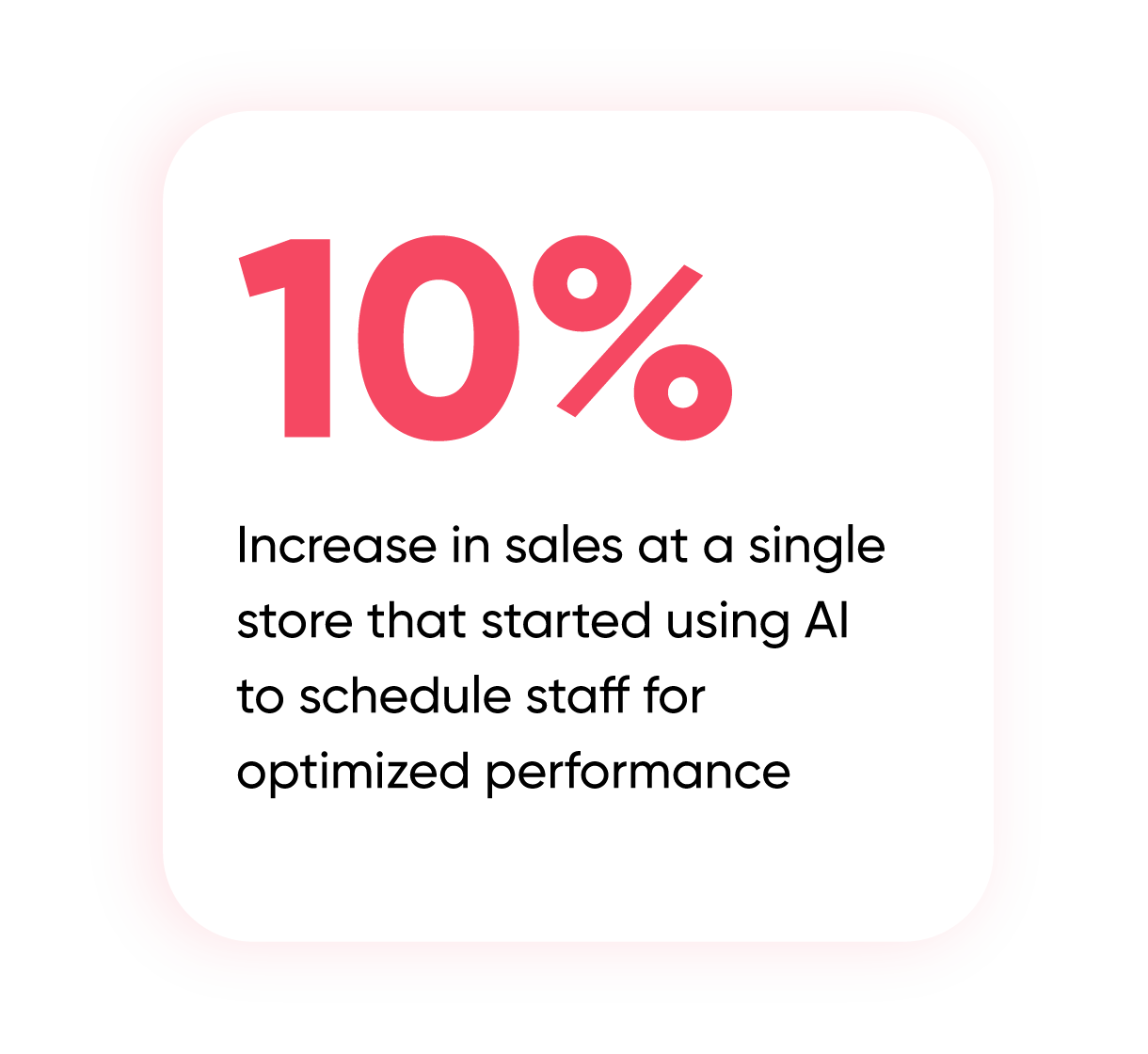

Scheduling in retail is plagued with oversights and inefficiencies that bog down retail performances and lead to worker burnout. In fact, 57% of retailers still manually set their employee’s schedules on a weekly basis—despite the significant time it takes and drawbacks in performance optimization.

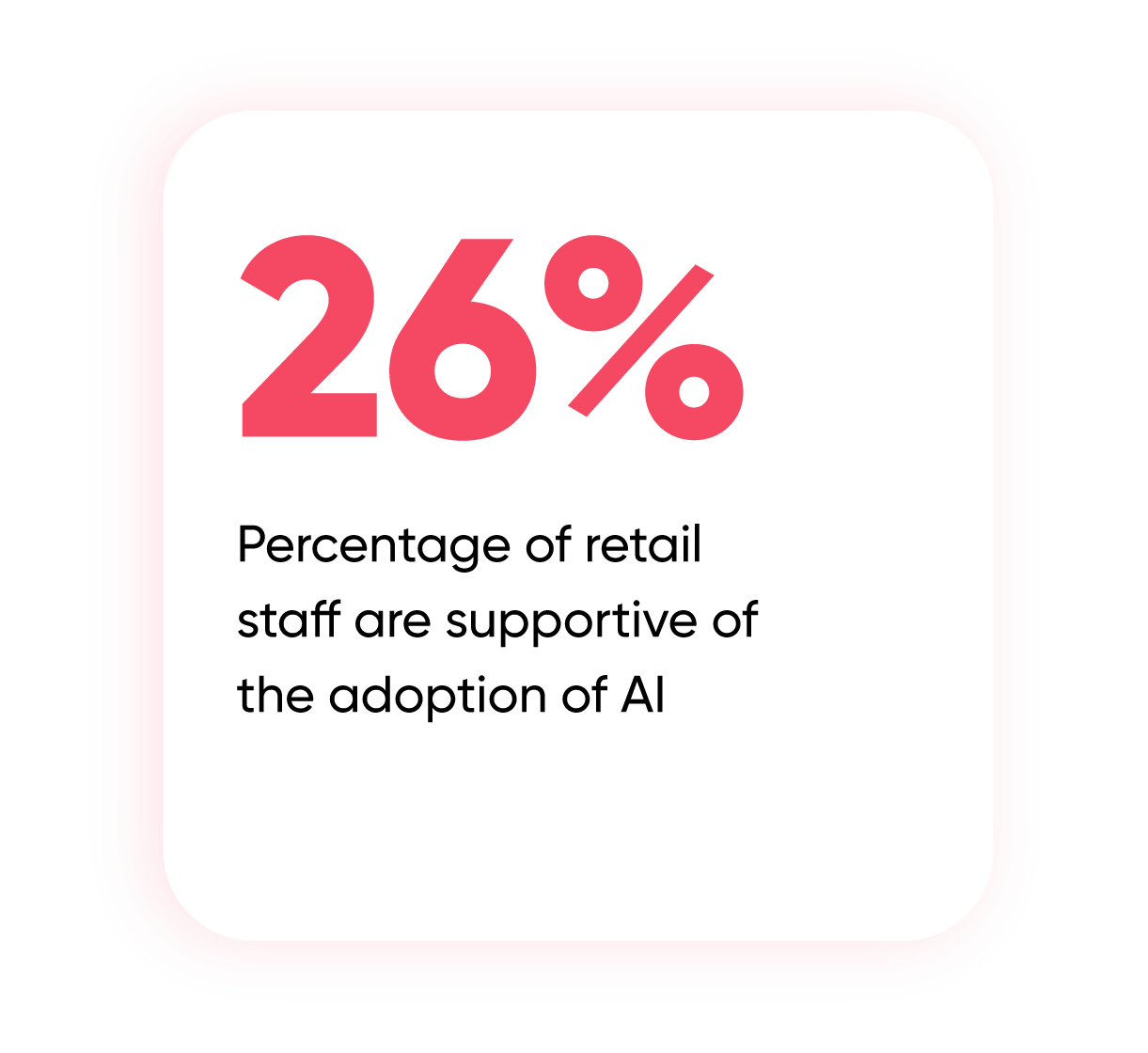

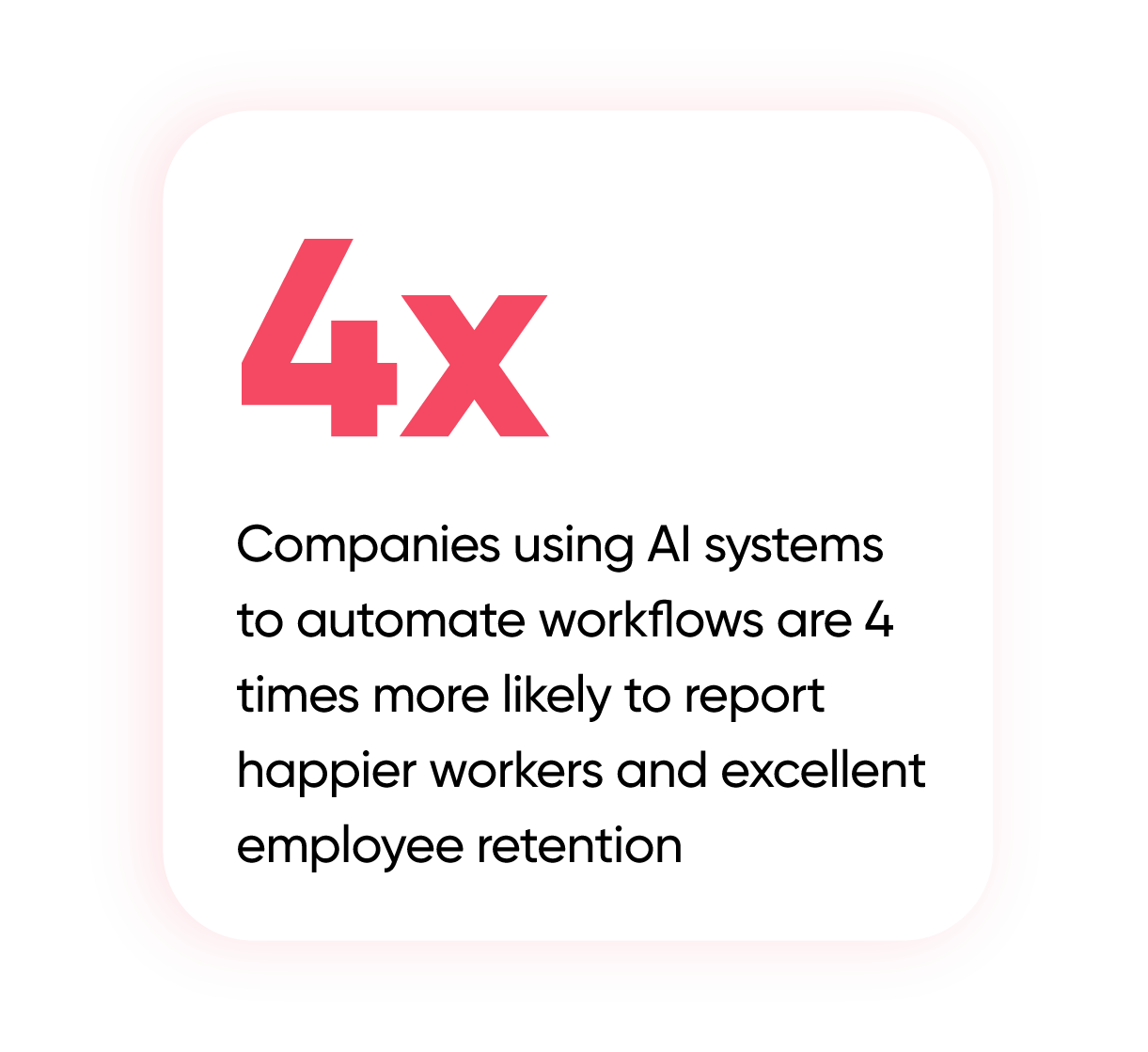

Artificial intelligence (AI) is a game changer when it comes to staff scheduling. It can go beyond plugging people into shifts and instead looks at the resources available and their impact on historical performance to chart the right path forward. AI can see trends in performance invisible to human eyes to create schedules with the shifts, people, and skills needed to maximize sales and operational efficiency. The other big benefit to AI is that it’s ready for volatility and makes re-organizing schedules to account for predicted and last-minute staff shortages almost instant.

Strategy 2

Keep store managers active on the floor

Getting store managers out of the office and onto the floor improves store performance during labor shortages, while also cutting down operational costs.

Store managers are the people on retail teams who know their brand’s products and customers best, and they provide the most value when on the floor coaching or selling to high-value clients. But in practice, many store managers end up spending much of their time stuck behind desks dealing with clerical busywork.

Rather than focus entirely on hiring new associates (who need to be trained), retailers need to ask how they can get their most knowledgeable and seasoned employees to spend more time on the floor. We’ve already talked about the importance of properly allocating associates, but managers are often overlooked.

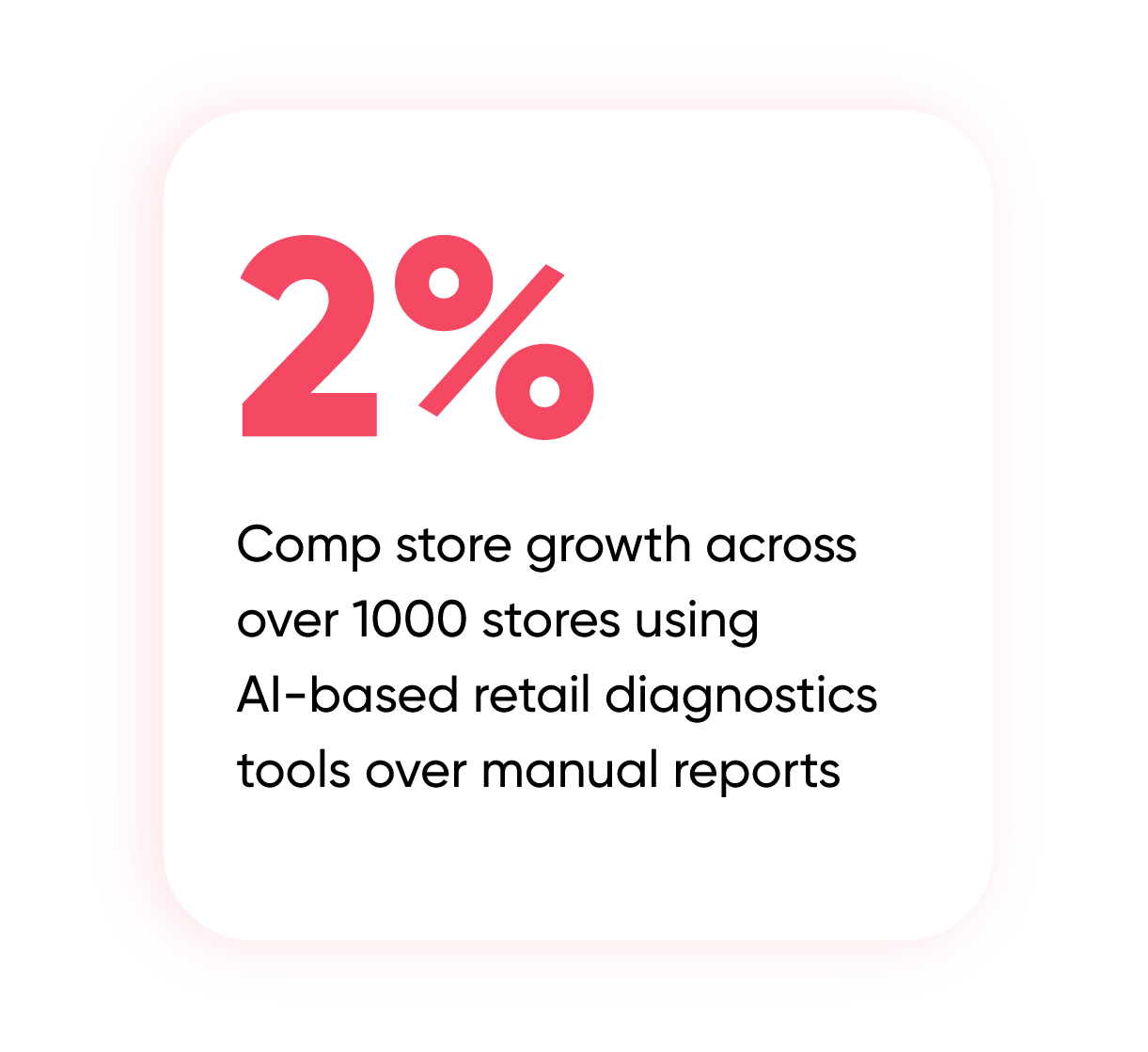

On top of almost-endless administrative work, most managers are expected to look at 25+ reports each week and spend hours going over the data, trying to draw conclusions and take action on them. Some store managers may have a knack for data, but for the most part this process is slow and the results are inconsistent from store-to-store and week-to-week.

Top brands are starting to pay attention to how store manager time is allocated and where they are expected to focus. They’re automating scheduling and other routine administrative processes and removing the burden of data interpretation with tools that diagnose problems, offer solutions, and free up managers to sell and coach.

Strategy 3

Train new hires faster and more effectively

New associates need to become brand experts across channels almost instantly and there aren’t always enough resources available to help train them.

Recruiting is tough, and there’s no one-size-fits-all approach. But the hard part really starts once the position is filled. It can take fresh associates months, if not years, to develop the expert level product, brand, and customer knowledge that today’s shoppers have come to expect. Historically, new hires could shadow more seasoned associates for extended periods and most were likely to stick around for multiple years, even if only on a seasonal basis. Now, social distancing makes shadowing difficult, it’s hard to justify the investment when staffing shortages mean everyone available is needed right away and high-turnover demands a very quick learning curve.

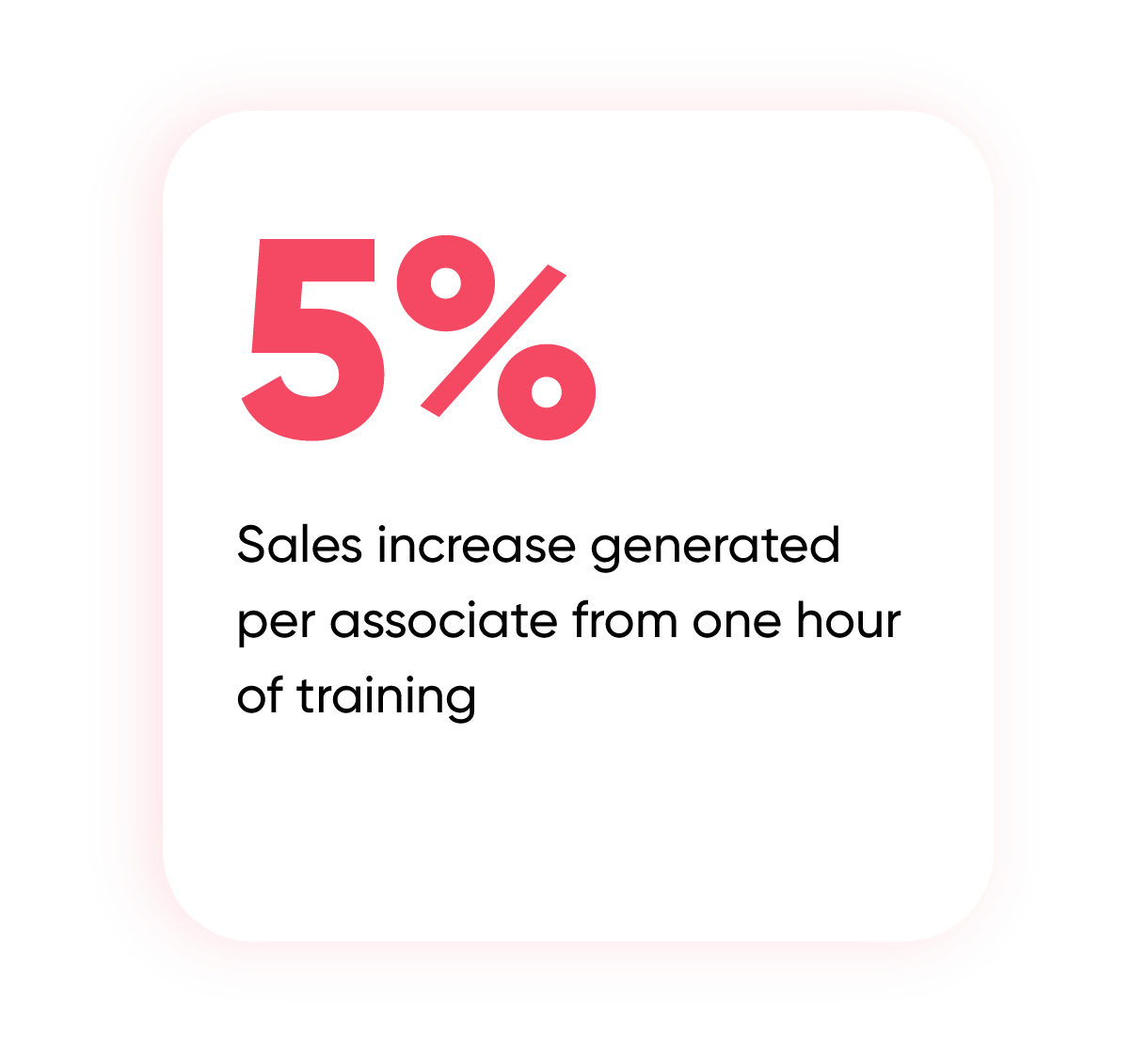

In response, retail employee onboarding processes are becoming smoother, shorter, and more intuitive so that even green associates can make sales and impress customers. 62% of new store associates received less than 10 hours of training, much of it is usually spent explaining how to use green screen systems and committing random-seeming key paths to memory.

Rather than trying to invest more time in onboarding, forward-thinking retailers are embedding training and instruction into the systems and tools already in use. After telling a new iPhone user where to find the ‘on’ button, they can largely figure the rest out themselves—and this is where retail is going.

Instead of expecting new associates to remember what goes in which binder and establish a sticky note system, they need to be fed an automated list of tasks and next steps to promote engagement with their clients, maintain brand consistency, and increase sales. This way, whenever a new associate starts a shift, they know exactly what needs to get done and none of their early tasks slip through the cracks because of confusion.

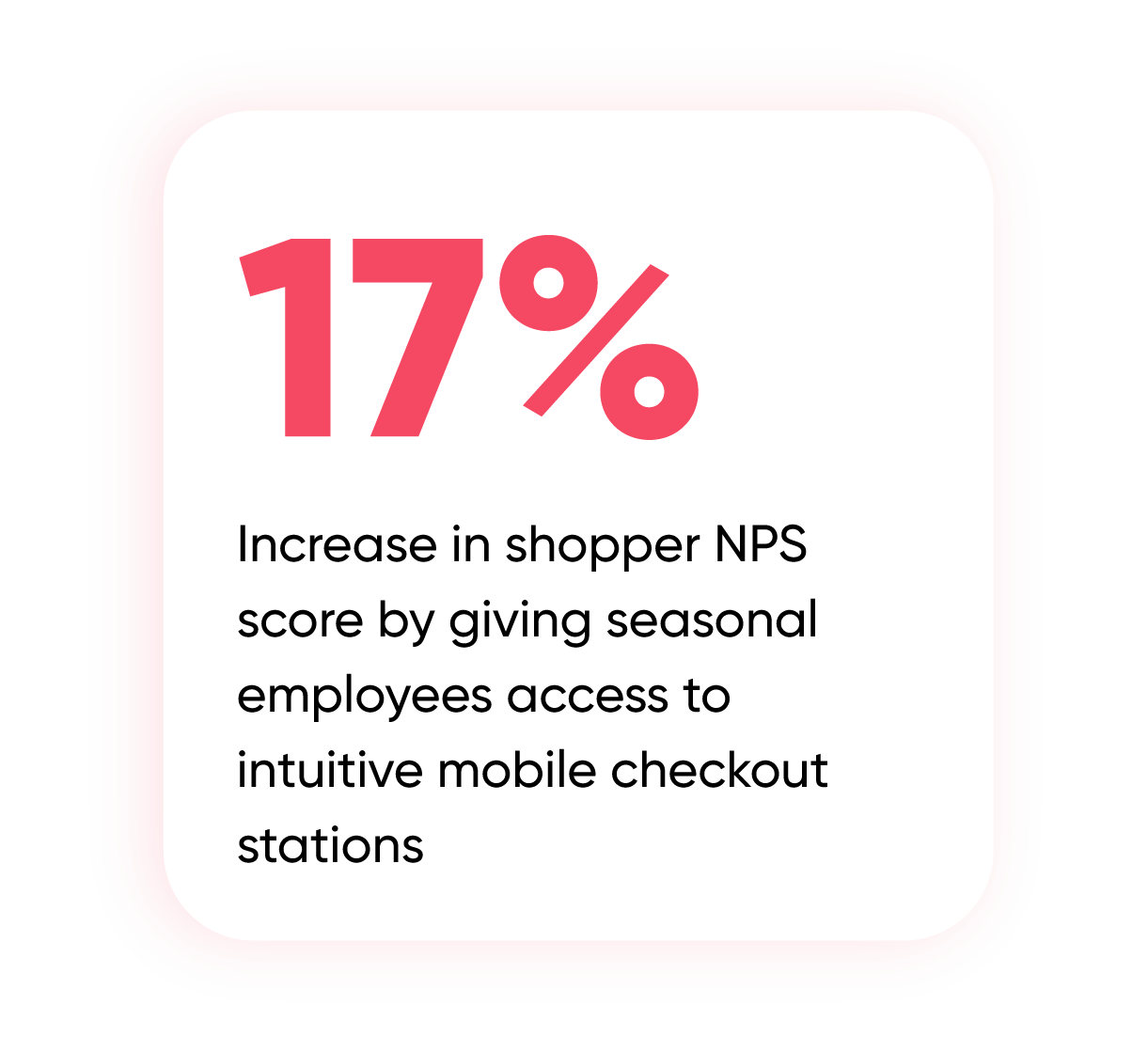

Once they hit the floor, it gets a bit more complicated. It would be almost impossible to train an associate for every customer request that might come their way, especially in their first few weeks. Customers may ask to check which size they wore last season, ship out-of-stock items to their home, split their order onto multiple baskets—the list is endless. Instead of trying to have new associates cram for every scenario, leading brands are overhauling their cash registers and core store systems and replacing them with intuitive, mobile-first tools that let associates view inventory, checkout, and handle customer questions with ecommerce-style efficiency.

Strategy 4

Create stronger pathways for associate success

To deliver the unified experience customers want, retail associates require systems and processes that put deep domain expertise and endless product access at their fingertips.

In this tight labor market, there is no room for underperformers. Today, the most successful associate functions like a digitally-equipped guide taking the customer through a channel-less journey. While some were historically able to do this through superhuman effort, the new labor climate means this has to be much more programmatic and consistent. But what does this look like in practice?

Firstly, associates need to be able to sell anywhere. Customers often come into the store to look at products and then purchase online and vice versa. It’s limiting to confine associates to just one channel when their customers are everywhere. Associates need to be able to answer questions for virtual shoppers, jump on a quick video call to show a product, or send styling recommendations over WhatsApp.

Secondly, customers have gotten used to ecommerce-style personalization, and they’re confused when 1:1 interactions with associates feel more impersonal than online ones. Ecommerce engines never forget a customer’s birthday—they have access to 360-degree profiles on individuals as well as tomes of filterable historical details and preferences that can be used to craft contextual interactions.

Top retailers are giving associates access to the same information so that they can build relationships with VIPs, send offers to the right groups, and offer real value to their customers. This used to be the exclusive domain of luxury retailers, but that’s no longer the case. McKinsey notes that “Personalization at scale (in which companies have personal interactions with all or a large segment of their customers) often delivers a 1 to 2 percent lift in total sales for grocery companies and an even higher lift for other retailers, typically by driving up loyalty and share-of-wallet.”

Finally, associates also need to be able to explain and find products, which has been made all the more difficult as a result of recent supply chain issues. It’s no longer enough for associates to know how to navigate the inventory on the sales floor. Retailers equipping their associates to show off and sell products that are out-of-stock or exclusive to other locations or channels without missing a beat (or losing the sales attribution) are leapfrogging their peers who are still stuck using more traditional models.

Strategy 5

Motivate talent to stick around

Workers across the country are leaving their positions and seeking better offers. Retailers need to focus on retaining top associates by providing fair compensation, advancement potential, and meaningful work.

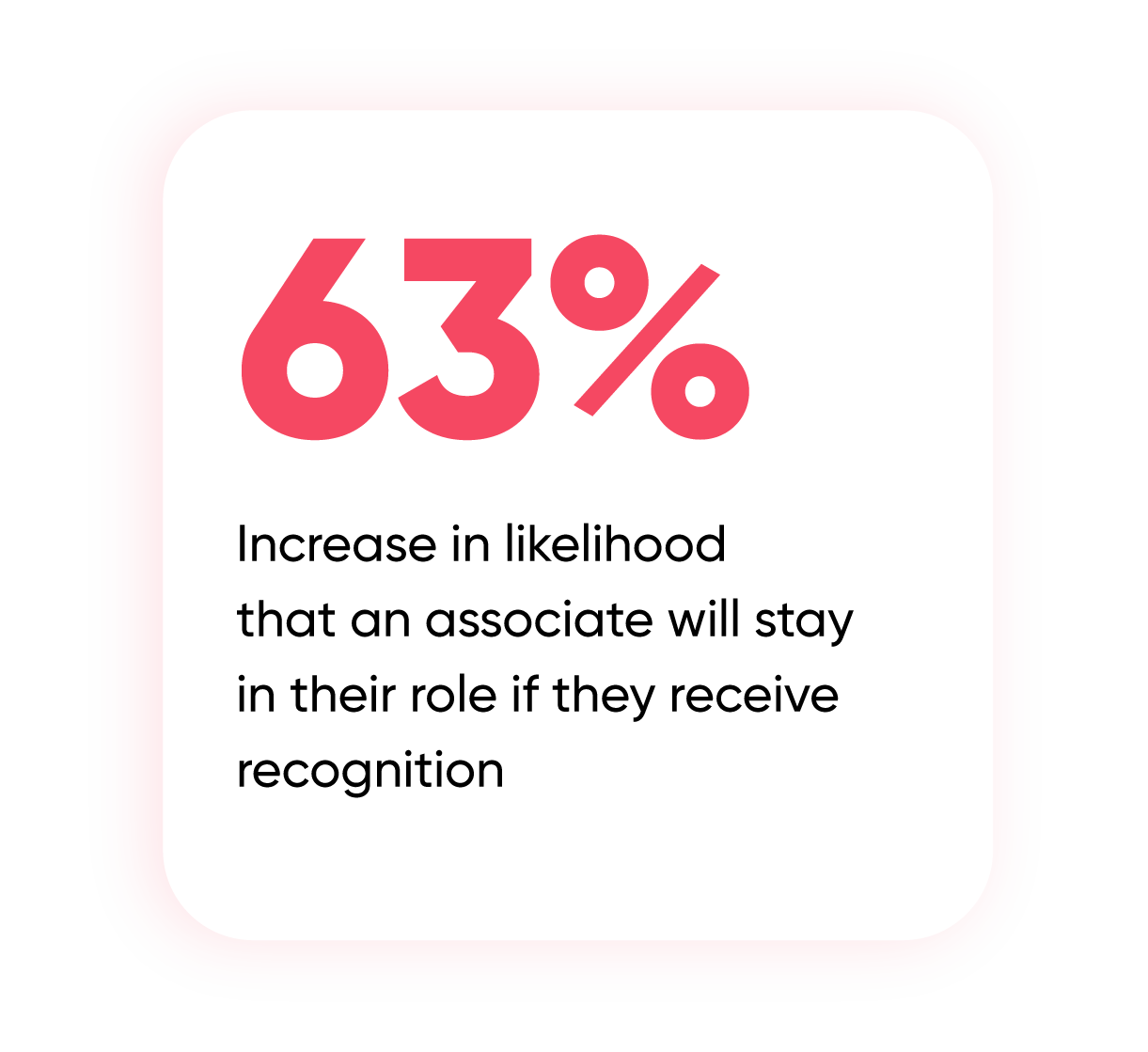

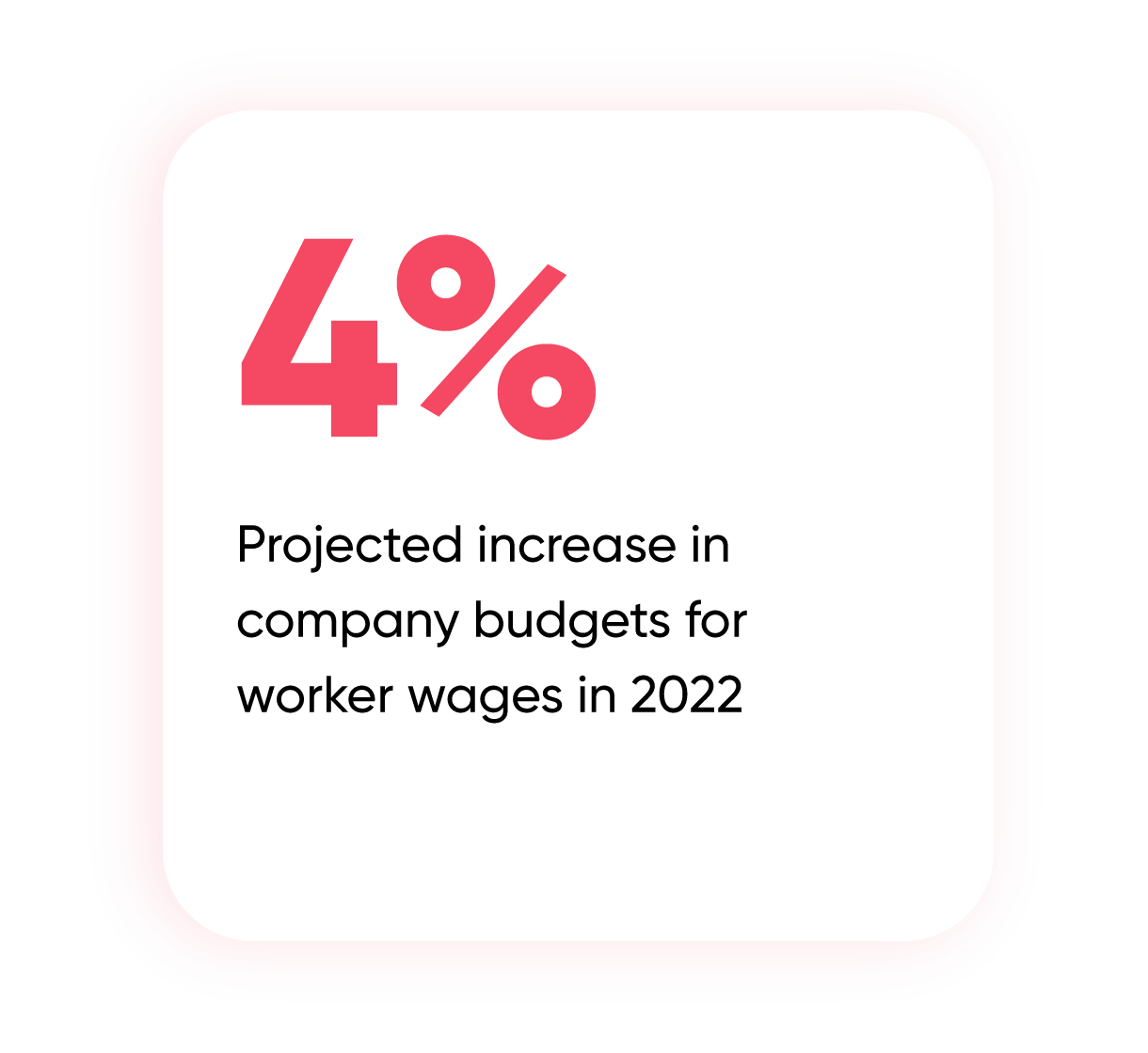

Enhancing retention rates for existing store associates is just as—if not more—important as acquiring new hires. The pandemic and the resulting inflation have made it clear that wages need to increase. Best Buy, Under Armour and Kay Jewelers have all raised their starting minimums to $15 per hour and many others have followed suit.

Employees want fair compensation, advancement potential, and meaningful work. In order to provide that without going into the red, retailers need access to transparent data that shows what’s happening on the sales floor and how it maps to ROI.

When head office can see exactly how store staff are influencing sales across channels, which levers move the needle, and who is leading the pack, it’s much easier to allocate dollars, labor hours, and promotions fairly.

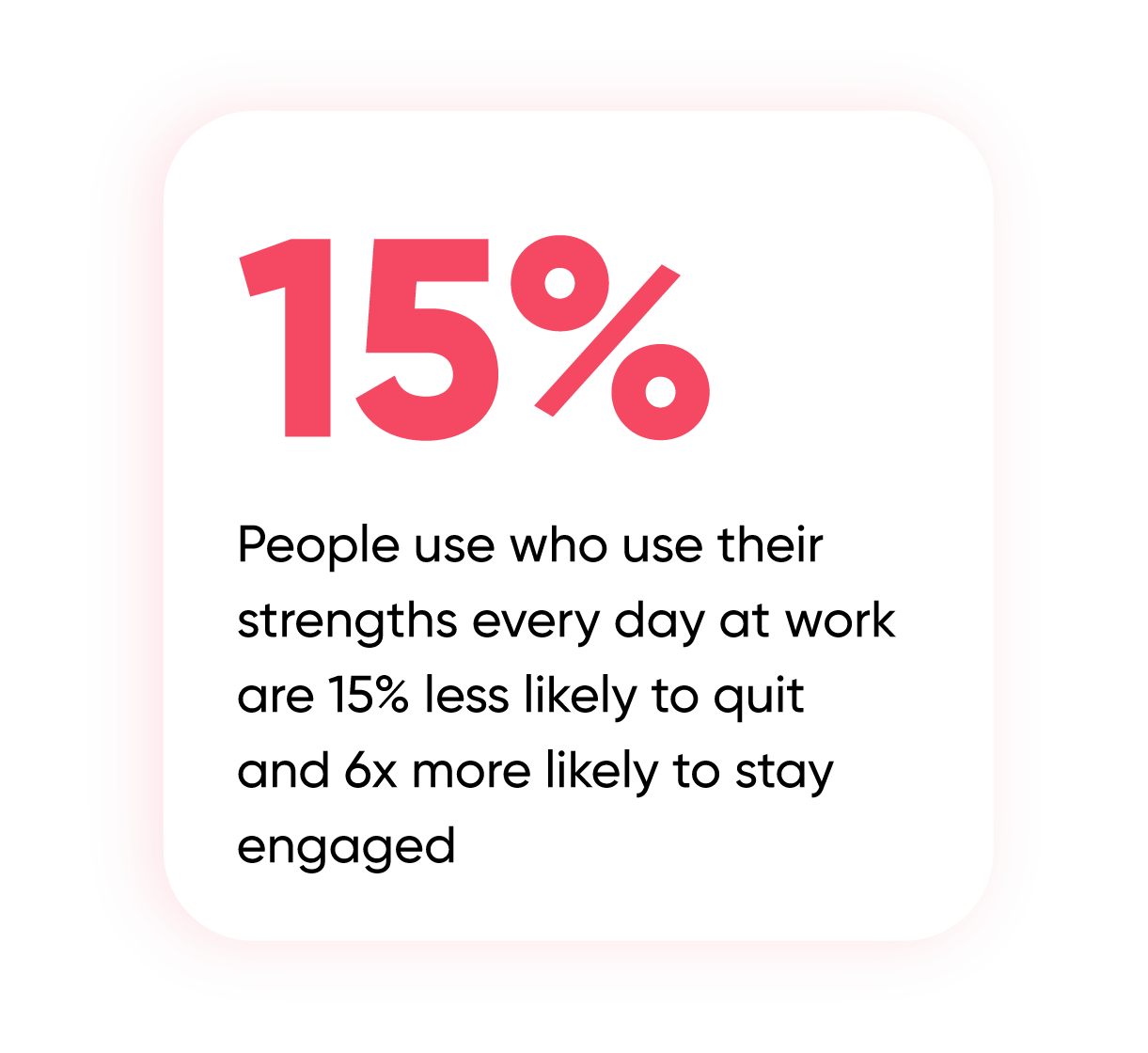

Retention isn’t just about external motivation. As Harvard Business Review notes, “Leaders determined to stem the tide of talent defections by simply throwing money or perks at the problem could be surprised to learn they’re barking up the wrong tree. If you’re genuinely committed to retaining your talent, you’re going to have to dig a bit deeper.”

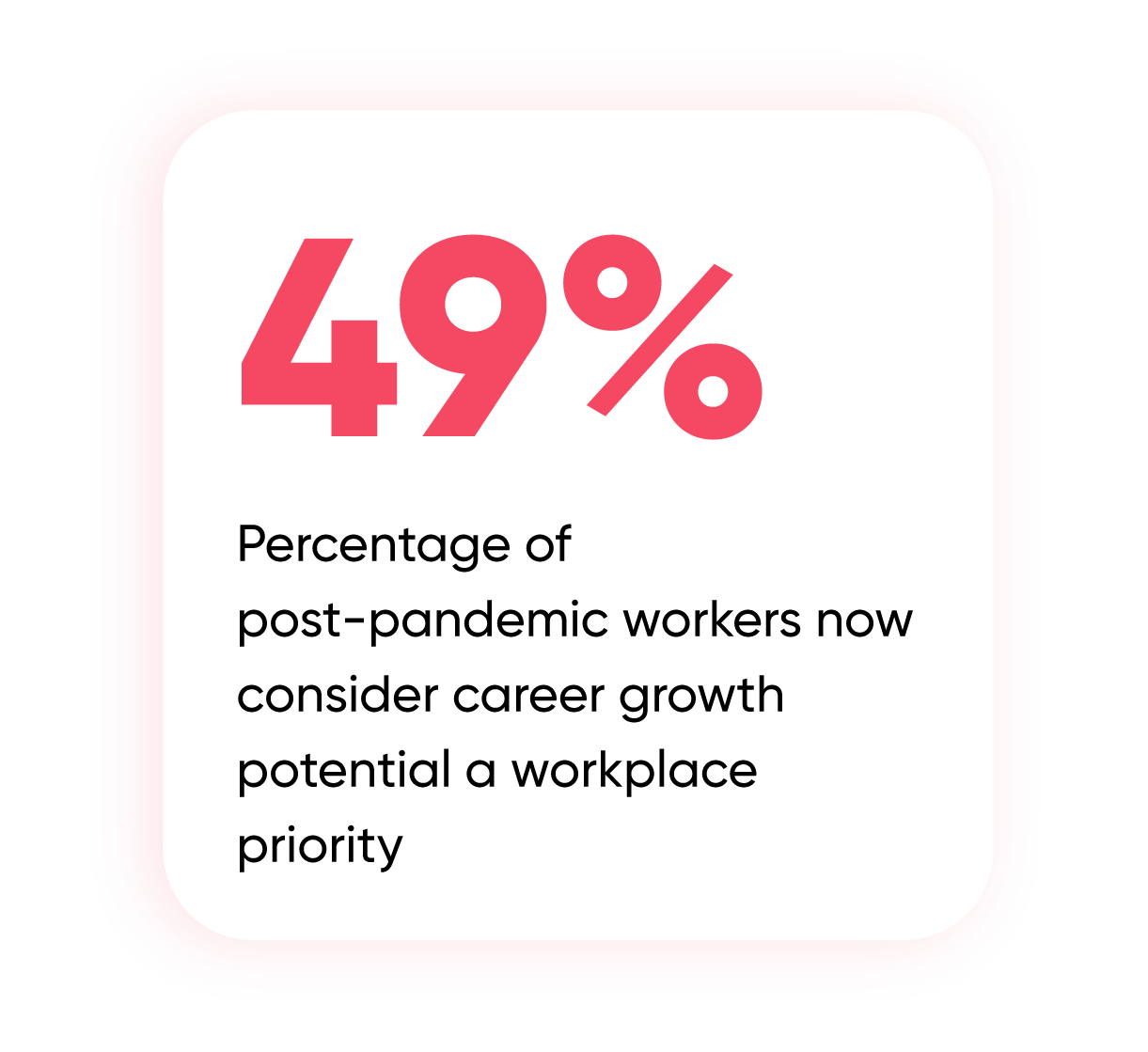

As we move into 2022, individuals increasingly want fulfilling jobs that let them grow and develop. They want to be able to see how they’re performing, how they’re contributing to overall goals, and what they need to do to level up.

Strategy 6

Expect employee turnover and manage it systematically

Even when retailers do it all right, some turnover is inevitable. When those transitions take place, store tasks, processes, and customer relationships need to be able to continue without disruption.

When employees leave retailers, operational inefficiencies and scheduling holes tend to ripple through their day-to-day operations. Other employees get overworked trying to pick up the slack, important tasks fall through the cracks, and customer relationships get lost in the shuffle.

When turnover was infrequent, these disruptions were easy to glaze over. Now, retailers have to expect a certain level of turnover even in their best-case scenario—and that means preparing for it. It’s not enough to be ready to act once a resignation has been received, instead forward-thinking retailers are (unfortunately) preparing for an associate to leave before they even start.

We had one luxury retailer tell us that although they inevitably had staff turnover, they hadn’t lost a single client in the shuffle. Broadly, they were aiming to create consistency and repeatability in the customer experience across locations and channels, but they also saw major benefits when it came to turnover.

The retailer went to great lengths to create a personalized high-touch customer experience propelled entirely by systems and processes. They looked closely at details that helped seasoned associates stand out, from texting using a real phone number to remembering fabric preferences—and transferred each element from institutional memory into a functional system that drove store operations and created consistency, even through turnover.

While customers value their relationships with specific associates, the true goal is to create a relationship with the brand that transcends individuals and channels. Even outside of luxury, customers are impressed when it feels like everyone they talk to—even when shopping online—knows them and knows exactly how to help.

What it takes to get ahead in an omnichannel world

To overcome this ongoing labor shortage (and any future surprises awaiting businesses), retailers must abandon or upgrade their outdated processes and focus on equipping associates for repeatable and measurable success.

This labor crisis has been raging for a long time now and it’s expected to continue into 2023 and 2024. To weather the rest of this storm and prepare for future volatility, it’s up to retailers to deploy thoughtful omnichannel strategies that cater to the needs of their store associates as well as they do their customers.

The pandemic has amplified weaknesses in how retailers typically allocate labor hours, motivate staff, and manage turnover. The same organizational transformations that allow retailers to succeed in the face of the labor shortage, also result in more engaged staff, better margins, and increased sales. At the end of the day, the goal is to create a resilient organization that can handle disruptions and changes on any link of the value chain.

About

Tulip provides a suite of cloud-based solutions that let retailers overcome industry challenges and set a new standard for omnichannel commerce. Partnered with Apple and Salesforce, Tulip equips sophisticated retailers to build connections with customers, fulfill orders, checkout purchases, and optimize operations in order to create the end-to-end experience modern customers expect. Leading retailers like Mulberry, Saks Fifth Avenue, Kendra Scott, Kate Spade, COACH, and Michael Kors use Tulip to elevate the shopping experience, increase sales, and improve customer service across channels.